Searching for affordable car insurance for young adults? Look no further! Our comprehensive guide covers everything you need to know, with expert insights and FAQs.

Introduction

Young adulthood is an exciting phase of life, but it also comes with increased responsibilities, including finding affordable car insurance. It’s crucial to secure your vehicle without breaking the bank. In this guide, we’ll explore the ins and outs of affordable car insurance for young adults, providing valuable insights and expert advice.

Are you a young adult looking for affordable car insurance? You’re in luck! In this blog post, we will explore the options available to you and provide you with some useful tips to help you find the best coverage at a price that won’t break the bank.

Understanding the Importance of Car Insurance

Before we dive into the topic of affordable car insurance, it’s essential to understand why having car insurance is so important. Car insurance provides financial protection in case of accidents, theft, or damage to your vehicle. It is a legal requirement in most countries and can save you from significant financial burdens.

Factors Affecting Car Insurance Premiums

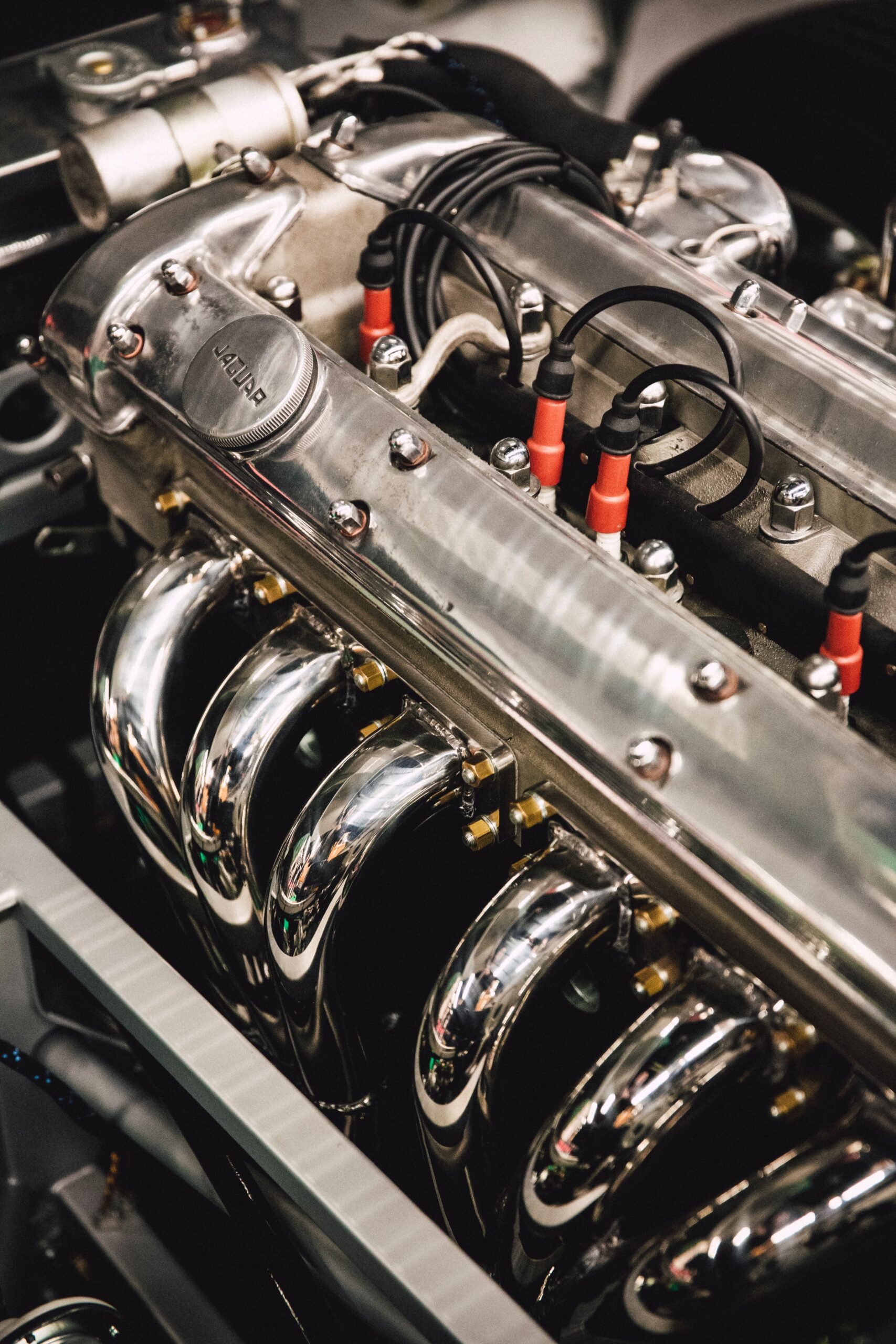

When searching for affordable car insurance, it’s crucial to consider the factors that affect your premiums. These factors include your age, driving experience, type of vehicle, and even your location. By understanding these factors, you can make informed decisions and potentially lower your insurance costs.

Shopping Around for the Best Rates

One of the most effective ways to find affordable car insurance is by shopping around. Different insurance providers offer varying rates, so it’s essential to compare quotes from multiple companies. Use online comparison tools or consult with insurance agents to find the best rates.

Taking Advantage of Discounts

Many insurance companies offer discounts that can significantly reduce your premiums. As a young adult, you may be eligible for discounts such as good student discounts, safe driver discounts, or discounts for taking defensive driving courses. Be sure to inquire about these discounts when obtaining quotes.

Opting for Higher Deductibles

Choosing a higher deductible can lower your car insurance premiums. However, it’s crucial to consider your financial situation before opting for a higher deductible. Make sure you can comfortably afford to pay the deductible in case of an accident or claim.

Benefits of Affordable Car Insurance for Young Adults

By opting for affordable car insurance, young adults can enjoy several benefits:

- Financial Protection: Affordable car insurance provides financial protection in case of accidents or damage to your vehicle.

- Compliance with Legal Requirements: Having car insurance ensures that you comply with the legal requirements of your country or state.

- Peace of Mind: Knowing that you are covered by insurance gives you peace of mind while driving.

Understanding Affordable Car Insurance

Affordable car insurance for young adults can be a lifesaver. It’s crucial to grasp the key concepts:

- Premiums and Coverage: Finding a balance between premiums and coverage is essential. You don’t want to pay too much, but you also need enough coverage to protect yourself and your car.

- Factors Affecting Rates: Factors like age, location, driving history, and the type of vehicle you drive influence your insurance rates.

How to Find Affordable Car Insurance

Securing affordable car insurance involves a few key strategies:

- Shop Around: Don’t settle for the first quote you receive. Shop around, get multiple quotes, and compare them.

- Bundle Policies: Consider bundling your car insurance with other policies, like home or renters insurance, for potential discounts.

- Safe Driving: Maintaining a clean driving record can lead to lower premiums over time.

LSI Keywords and Their Importance

In the realm of affordable car insurance for young adults, understanding LSI (Latent Semantic Indexing) keywords is critical. These keywords help search engines understand the context of your content, making it more relevant. Here are some key LSI keywords:

- “Budget-Friendly Auto Insurance”: This keyword hints at affordable options for young adults.

- “Young Driver Discounts”: Highlighting potential discounts for youthful drivers.

- “Car Insurance Savings”: Emphasizing cost-effective options.

The Importance of Affordable Car Insurance

Affordable car insurance provides peace of mind, but it’s more than that:

- Legal Requirement: In most places, having car insurance is a legal obligation.

- Financial Protection: It safeguards your finances in case of an accident.

- Emergency Support: You’ll have a safety net in emergencies.

FAQs about Affordable Car Insurance

Q: Can I get affordable car insurance as a young adult with a limited budget?

A: Yes, there are insurance options available for young adults with limited budgets. By shopping around and exploring different insurance providers, you can find coverage that fits your budget.

Q: What can I do to lower my car insurance premiums?

A: There are several steps you can take to lower your car insurance premiums. These include maintaining a clean driving record, opting for a higher deductible, and taking advantage of available discounts.

Q: What’s the ideal coverage for young adults?

A: The right coverage depends on your individual circumstances. Generally, liability coverage and collision coverage are good starting points.

Q: How can I lower my car insurance premiums?

A: Maintaining a clean driving record, bundling policies, and choosing a safe vehicle can help reduce premiums.

Q: Are there discounts specifically for young adults?

A: Yes, many insurers offer discounts for good grades, driver training courses, and safe driving records.

Q: What’s the role of deductibles in car insurance?

A: Deductibles represent the amount you pay out of pocket in case of a claim. Higher deductibles can lower your premiums but mean you pay more in the event of an accident.

Q: Can I switch insurance providers easily?

A: Yes, you can switch providers at any time. However, it’s essential to avoid any lapses in coverage.

Q: How can I ensure I’m getting the best deal?

A: Regularly compare quotes from different insurers to make sure you’re getting the best deal.

Conclusion

As a young adult, finding affordable car insurance is crucial for your financial well-being. By understanding the importance of car insurance, considering the factors that affect your premiums, shopping around for the best rates, and taking advantage of discounts, you can find coverage that provides both protection and affordability. Remember to compare quotes, ask about available discounts, and choose a deductible that suits your financial situation. With the right approach, you can secure affordable car insurance and drive with peace of mind.

Affordable car insurance for young adults is not just a financial decision; it’s a crucial step in protecting your future. With the right knowledge and strategies, you can find the perfect balance between cost and coverage. Remember, it’s all about driving confidently into adulthood.